Energy Saving Tips

STC Solar Rebate

STC Solar Rebate is a government incentive that makes solar more affordable for Australian…

Solar Finance can be a good idea. The reason is the currently there is a Federal Government rebate helping with the solar purchase. These are called STC’s – Small Technology Certificates. This rebate reduces every year by around 7%. Currently in 2021 with a 6.6kW residential solar system consumers will get just over $3,300 in support.

So if you have not got the cash for solar today, and wait for example three years, you could have lost close to $1000 in rebate support. Solar with finance, given the current low-interest environment, can still give you great savings.

*This graph is not an accurate reflection of the financial outcome for each customer. It is there to highlight the overall beneficial opportunities of solar finance.

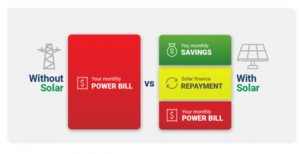

At SolarBright we offer several ways to finance solar through our partners with easy monthly instalments, which are often lower than the amount of electricity savings you will enjoy. So this means financially you will be ahead from day one.

Some of the major finance options we offer at SolarBright are:

A Brighte Green Loan is a type of credit provided by Brighte to a customer on the condition that the money is used for something the lender deems eco-friendly such as solar PV systems, home batteries, MaxBreeze or solar hot water products.

A Brighter Green Loan is structured much the same as a personal loan. However, a green loan is used to finance energy-efficient products and benefits from a reduced rate compared to a personal loan.

Aside from the loan’s purpose, the eligibility criteria for the Brighte Green Loan is similar to those for other credit products.

When you apply, Brighte will consider your income, credit history (and credit score), whether you are an Australian citizen/resident, and whether you have filed for bankruptcy in the past.

You will be required to provide Brighte with your personal information, including your address and phone number, as well as proof of your income, employment status, assets etc.

Brighte offers a fast and easy payment platform and a quick and simple application process.

The Brighte Green Loan has an easy to understand and complete application process and our friendly staff can assist you with some general questions you might have about this finance option about the details.

Brighte’s Green Loans offer a long loan term varying from 2 to 7 years, and they come with a fixed interest rate of 5.89% p.a. A range of $1,000 to $30,000 can be borrowed and there is an account keeping fee of $1.50 per week, and a loan establishment fee applies. The loan terms can go from 24 to 84 months.

The eligibility criteria include to be over 18 years old and an Australian resident or citizen; to own or purchasing a home; be employed, self-employed, a self-funded retiree; or receiving the Government Age Pension; have an Australian driver’s license or Passport or Medicare Card and provide the two most recent payslips or 90 days of bank statements. Another advantageous feature of Brighte’s finance options is that there are no early repayment fees.

Plenti previously known as RateSetter has financed many thousands of residential and commercial solar systems over many years.

They provide both variable and fixed unsecured personal loans. Their interest rate is linked with the length of the loan, the amount applied for and the information you provide in your application.

Plenti strives to build a ‘smarter, fairer and faster’ borrowing experience and SolarBright has been using them with a high customer satisfaction level for many years.

The lending platform is not only simple to navigate, but makes it quick and easy to check your rate, fill in the application, get the approval and finalise your loan

Plenti offers a personalised rate that rewards you for your good credit history. The interest rates can start from a low of 6.5% per annum.

A Plenti loan allows you to benefit from solar sooner and more easily than you would otherwise be able to. Paying for your solar energy system while enjoying the savings often results in money in your pocket right away with a good return when comparing your new energy bills to what you’re paying per month.

Our friendly SolarBright staff can run with you through your likely solar savings and the regular loan payments to show you how the loan for solar can be financed relatively easily.

The Plenti loan terms range from 3 to 7 years, and with many plans to choose from, it’s easy to find the one that’s just right for you. Making the switch to solar helps save the environment and helps you save big money in the long term.

Their green personal loan is flexible, allowing you to borrow an affordable amount between $2,001 to $50,000 that they feel confident is within your capability to repay, over the 3 to 7 years term.

They do not charge early repayment fees, so if you have an additional income and decide to pay back the loan earlier – no problem. One key condition for the loan is that you have an annual income greater than $20,000.

Energy Ease is an Australian payment option provider that specialises in commercial solar and energy efficiency projects. They boast no upfront payments and instant pre-approval on their competitive payment plans.

Energy Ease is geared towards businesses looking to finance their large-scale energy-saving projects to cut down their power bills, with payment plans that span from $3,000 to $5 million and repayment terms of up to 10 years.

Energy Ease offers a range of solar financing options as Power Purchase Agreements (PPA), Performance Guarantee Agreements (PGA) and Loan/Chattel Mortgage.

SolarBright’s Commercial Solar specialists have assisted our clients with guiding them through the Commercial Solar Finance process in many instances and can assist you anytime.

Power Purchase Agreements are ideal for companies that are committed to reducing their carbon footprint but do not have the substantial physical space to install their own renewable energy system or do not want the liability of maintenance upkeep.

Performance Guarantee Agreements are similar to a Power Purchase Agreement, but also comes with a performance guarantee on your system’s electricity generation, only available through select Energy Ease premium installers such as SolarBright.

Their Loan/Chattel Mortgage allows you to own the solar equipment from day one with no upfront costs, as well as claim depreciation on the equipment on your balance sheet.

The equipment itself serves as security for the loan, and often, the interest of the loan repayments are tax-deductible.

These finance products each have their own pros and cons that must be considered to choose a loan or financial product most suitable to your solar power installation needs and situation.

Talk to us about your commercial solar needs and finance options today.

Take a Look

Energy Saving Tips

STC Solar Rebate is a government incentive that makes solar more affordable for Australian…

Solar Battery

A Virtual Power Plant is a network of connected solar batteries, typically located in…

Solar Panels

Installing solar panels is one of the quickest and most effective ways to start…